Personal Expenses Classification on E-Fatura portal in AT

- Max Egorov

- Feb 4

- 2 min read

What is this all about?

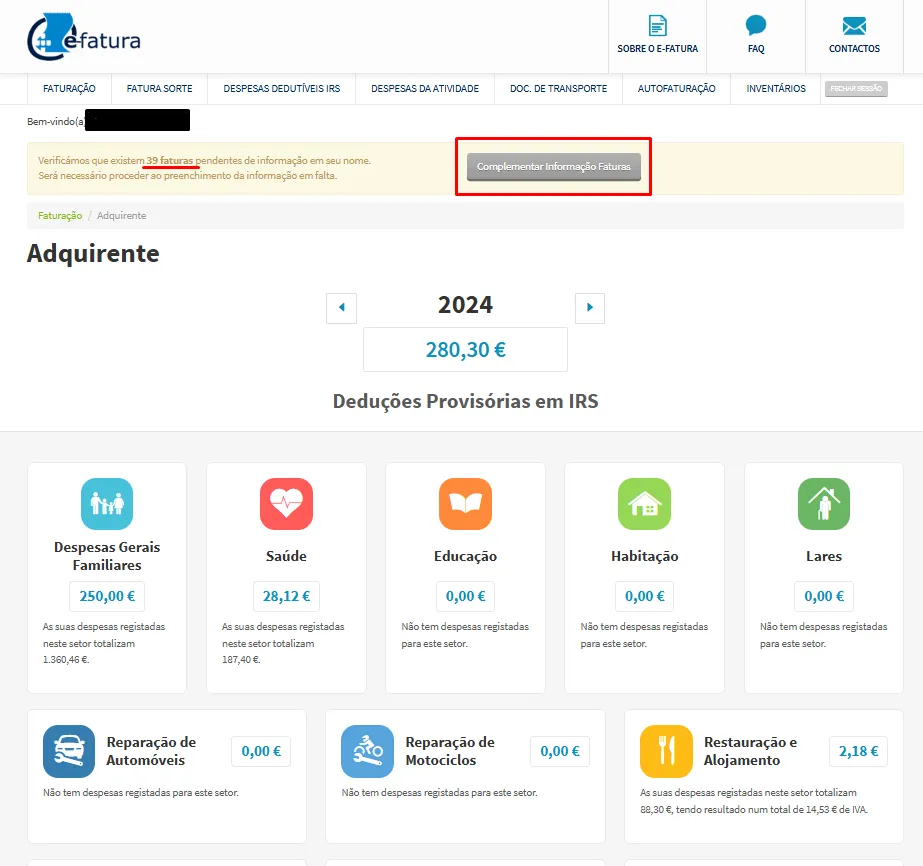

25th of February of each year is the deadline to classify your personal expenses on AT E-Fatura portal.

What benefits can I get by doing this?

It is necessary to clearly distinguish the situation of Personal Expenses from Expenses related to Sole-Entrepreneur (TI) activity and clearly understand the scope of deductions which can be applied to each one.

For Personal expenses

There are multiple categories of personal expenses, which can be used to subtract from the personal income tax, like Healthcare, education, etc. However the total deduction for all categories can not exceed THE LIMIT of 1500 EUR per year.

For Sole-Entrepreneur expenses

Sole-Entrepreneurs on simplified regime the reduction coefficient may be applied to your income depending of your category of business (CAE). To get this reduction coefficient, tax authorities require you to prove at least 15% of expenses related to your business activity, so you could claim the right to apply reduction coefficient. The total amount of reduction, CAN NOT EXCEED the coefficient, determined for your CAE code of activity.

Separate situation is with Organized accounting regime. When you have organized accounting regime, your business revenue is calculated by accounting, so this classification is more about personal expenses.

On top of that, for both Personal and Sole Entrepreneur expenses tax authority resolve the right to decline certain expenses as non applicable to the activity (such as apartment rental payments, groceries, transportation and other personal expenses).

To summaries, classification of Personal and Sole-Entrepreneur expenses, has a lot of restrictions and doesn't guarantee any actual deductions or applicability of reduction coefficients.

How to do it?

To categorize your expenses in the E-Fatura section:

Go to “Complementar Informação Faturas”.

Follow these instructions based on the type of expense:

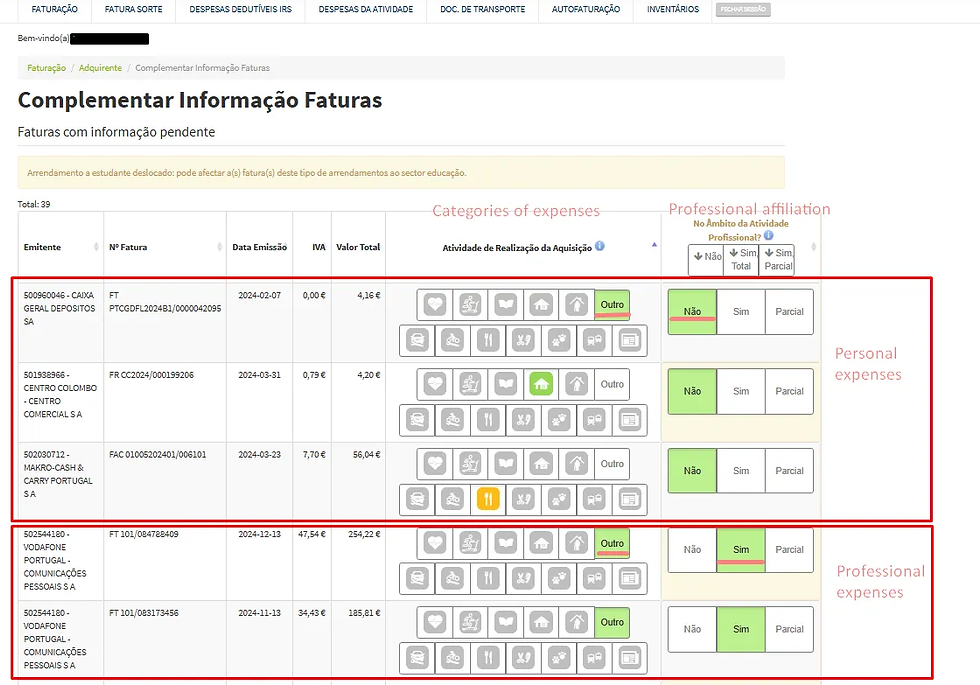

For personal expenses, ensure the correct category is selected in the “Categories” column. In the “Relation to professional activity” column, select “NO”.

For professional expenses, choose “OUTRO” in the “Categories” column. In the “Relation to professional activity” column, select either “SIM” (Yes) or “PARCIAL” (Partial), depending on the nature of the expense.

Don't forget to Save it at the end!

Conclusion

If you're struggling to determine the impact of expenses on your personal tax situation and you're not sure which tax regime on expenses is most suitable for you, fell free to schedule on online consultation with our expert accountants to determine the most beneficial tax strategy for you. Apply coupon code KILOBLOG to get 20% discount on 1st consultation.

.png)